The Bear Chasing Its Tail

An Imaginary Conversation at the Cato Institute Between John Maynard Keynes, Alan Watts, and a Crypto-Philosopher

By Beezone

Editor’s Introduction

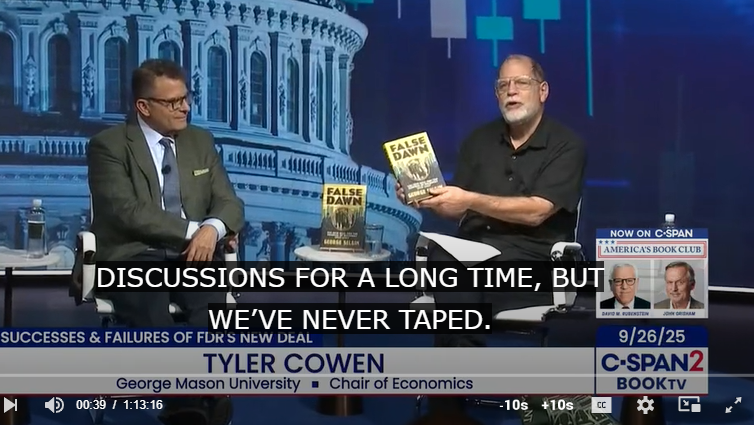

In September 2025, the Cato Institute with Tyler Cowen hosted an interview with economist George Selgin about his book False Dawn: The New Deal and the Promise of Recovery, 1933-1947.

The discussion revisited Franklin Roosevelt’s monetary policies, the gold standard, and the Great Depression’s enduring questions about value and trust.

Listening to that exchange, I found myself struck less by the technical arguments than by the deeper psychological drama beneath them — the human story of fear, belief, and the endless search for security that drives every economic system.

From that reflection emerged The Bear Chasing Its Tail: an imagined symposium where John Maynard Keynes, Alan Watts, and a modern crypto-philosopher meet across time at Cato’s own podium.

Their dialogue weaves together policy, philosophy, and technology — showing how the same forces that shaped the 1930s still move today’s markets and minds.

If there is a “winner,” it is not the economist or the technologist but the philosopher who reminds them both:

Trust in existence — but handle the business of life with wisdom.

What follows is that conversation.

Summary

A fictional symposium set in the marble hall of the Cato Institute brings together three minds across time. Keynes seeks to steady civilization through policy; Watts exposes the spiritual irony behind wealth and fear;

and a modern crypto-philosopher tries to anchor trust in code. Their exchange unfolds around one paradox:

“We’ve made scarcity our security.”

What begins as an argument about economics becomes a meditation on fear, faith, and the forgotten art of trusting existence.

Preface

Every economy begins as a story of survival. Beneath its charts and policies runs the ancient pulse of fear and desire—the human need not only to live, but to go on living. From that need we built systems of wealth, money, and power—outer structures reflecting our inner struggle to feel secure. They measure not simply production or exchange but the degree to which we trust existence itself.

Gold, paper, and now digital code each mark a chapter in this psychological experiment: an effort to make permanence out of impermanence, to turn the anxiety of survival into the comfort of possession. But each attempt, driven by fear, circles back upon itself—the bear chasing its tail—until the pursuit of security becomes the engine of insecurity.

Here, three voices meet across time:

John Maynard Keynes, who sought to manage uncertainty through policy; Alan Watts, who sought to dissolve it through awareness;

and a contemporary crypto-philosopher, who seeks to encode trust itself in mathematics. Between them runs one question: Can civilization ever transcend its fear of scarcity—or is that fear the very basis that keeps it alive?

The Dialogue

Moderator: “Our title today, The Bear Chasing Its Tail, names the paradox at the heart of economics: the systems we design to secure life often bind it instead.

Let us begin with that ancient anxiety—scarcity—and how it shapes our sense of value.”

Keynes: In 1933 the world lost faith.

Banks were temples of fear. Gold was hoarded while men starved.

My task was to restore confidence—to remind society that fear itself was our real poverty. When everyone hoards, production dies. The cure was not austerity but action—spending, employment, circulation.

Watts: Ah, circulation! The word itself breathes. You wished to keep the dance moving, Maynard; so do I. But scarcity is not merely a shortage of goods—it’s the fear that there will never be enough of me to meet the world.

We treat the flow of existence as hostile rather than hospitable.

That’s the irony: an abundant cosmos filled with creatures pretending to starve.

Keynes: Yet hunger is real. Governments must answer to bodies, not metaphysics.

I needed instruments—taxation, public works—to turn hope into bread.

Watts: And bread begins in trust:

the farmer trusts the rain, the baker the yeast, the eater tomorrow’s dawn. The true economy is a web of mutual giving. Our mistake is to hoard the tokens of that trust—money, power, credit—as if we could store life itself.

Crypto-Philosopher: You both rely on faith—faith in government or in cosmic rhythm. Our age seeks something verifiable: a network of transparent exchange where trust is mathematical. Blockchain makes deceit costly and honesty cheap—digital karma.

Keynes: “Digital karma? You have replaced gold with code and priests with programmers. When fear grips markets, will your algorithms console the hungry? Policy must be human, not mechanical.

Watts: Logic, like gold, is a lovely servant but a dreadful master.

Mathematics cannot feel compassion, and compassion is the true currency of civilization. If your code teaches fairness, wonderful. If it becomes another idol of control, we’re back where we began—security as scarcity.

Crypto-Philosopher: Perhaps that’s already true. Our revolution was born in fear—fear of governments, inflation, manipulation. We built machines to guarantee survival and found ourselves ruled by volatility. Maybe we’ve made scarcity our security.

Watts: That’s the cat chasing its tail. We seek peace through protection, and protection breeds anxiety. We cling to money, institutions, or code, forgetting that life itself is trustworthy. The art is not to renounce the world but to play in it— to handle the business of living with the wisdom of those who knew the dance between want and wonder.

Keynes: You dissolve fear through awareness; I through employment. Perhaps both roads lead to the same end—faith restored, circulation renewed.

Watts: Participation is wealth. When giving and receiving flow freely, no one need clutch. The real economy is the economy of being— trust in existence, expressed through work, exchange, and laughter.

(A long silence. The audience doesn’t applaud; they breathe.)

Epilogue

Later, in the corridor, someone remarks that Watts seemed to “win.”

But he would have laughed at the notion of victory. His irony was never against Keynes or the cryptographer—it was against fear itself.

For those who take the time to see deeper underlying causes and the economist alike, the problem was never merely money, gold, or code, but the ancient conviction that conventional, physical existence — the visible surface of life — is all that there is. It must be considered, and understood, at a deeper level.

A boat and its engines move across the surface, contending with wind and weather, but it is the unseen currents below that determine its course.

So it is with civilization: its policies and technologies steer above, but the deeper movements of consciousness — trust, fear, generosity, awareness — decide its true direction.

Further Reading

Gold, Code, and the Search for Trust

Every age invents its own “incorruptible” money — first metal, then paper, now code. These five books trace how the longing for certainty beneath economic systems has simply changed its form.

1. Nathan Lewis — Gold: The Once and Future Money

(John Wiley & Sons, 2007)

Lewis shows how the classical gold standard worked as a self-balancing system and why it continues to haunt economists.

Gold’s promise of objectivity is the same psychological refuge sought by today’s “digital gold.”

Scarcity becomes moral certainty.

2. George Selgin — Good Money: Birmingham Button Makers, the Royal Mint, and the Beginnings of Modern Coinage, 1775–1821

(University of Michigan Press, 2008)

A vivid history of private coinage during Britain’s Industrial Revolution—entrepreneurs minting trusted money when the state could not.

What blockchain coders call “decentralization” was once a physical craft.

Both express the same intuition: that trust can emerge from below.

3. Saifedean Ammous — The Bitcoin Standard: The Decentralized Alternative to Central Banking

(Wiley, 2018)

Ammous’s polemic casts Bitcoin as the heir to hard money, arguing that algorithmic scarcity can restore discipline to value.

The dream of incorruptible code mirrors the old faith in incorruptible metal.

Both imagine salvation through limit.

4. Barry Eichengreen — Globalizing Capital: A History of the International Monetary System

(Princeton University Press, 2019)

A clear historical map from the gold standard to Bretton Woods and the present floating-currency order.

Shows how each generation oscillates between fixed standards and managed trust—

the surface motion of the boat while deeper currents of fear and faith remain unchanged.

5. David Graeber — Debt: The First 5,000 Years

(Melville House, 2011)

An anthropologist’s long view of money as relationship, obligation, and imagination.

Graeber reminds us that before gold or code, value lived in shared memory and moral reciprocity—

the same current that Watts calls “trust in existence.”

Optional Companions

-

Friedrich Hayek — Denationalisation of Money (1976) – early vision of competitive private currencies.

-

Christine Desan — Making Money: Coin, Currency, and the Coming of Capitalism (2014) – how law and belief co-created modern money.

Closing Reflection

Gold promised purity.

Code promises transparency.

Both seek to anchor trust outside the human heart.

But the deeper current, as Watts reminds us, is still within —

the capacity to share, to believe, and to let its measure flow.